HOGAN

An independent asset management firm fully dedicated to equity management, specializing in generating returns through investments in liquid stocks of Latin American companies.

Hogan offers three different equity investment strategies, delivering consistent and uncorrelated high-value-added returns, based on fundamental analysis and a robust investment process.

Founded in 2004, previously named Victoire Brasil Investimentos, Hogan is now 100% owned by its executives and is always committed to continuous improvement through processes and transparency..

Why Hogan?

DNA

We are an independent asset manager dedicated to extracting uncorrelated returns in equities, driven by a constant appetite for learning and continuous improvement in our processes.

TEAM

• Our investment team dedicates 100% of their attention to an analytical framework guided by transparent and systematic discipline, valuing objectivity and critical thinking in research and decision-making.

• We seek synergy through a collective effort.

• With shared leadership roles and individual and collective responsibilities, the team’s performance is measured by the performance of the funds and portfolios.

• We discuss, decide, and perform the real work collaboratively, always aware that in building convictions, there is a continuous process of interaction, data validation, and information verification.

Ignácio Cerezo

Member of the Executive Committee and Risk & Compliance Director – CEO

Ignacio joined Hogan Investimentos in February 2020 as Partner, General Director, and coordinator of the Risk & Compliance Committee of the firm. Ignacio has 40 years of experience in financial markets.

Before taking on his role at Hogan, always based in São Paulo, Ignacio served as General Director and Head of Institutional Sales at Principal Global Investors for 13 years (from 2006 to 2019) and was a member of the International Executive Committee (Operations and Business) of the Asset Management division. Between 1996 and 2006, Ignacio led Citigroup Asset Management Latin America (with $24 billion in AUM) and, prior to that, he was the Director responsible for institutional fixed income sales at J.P. Morgan in London and New York.

He holds a master’s degree in History from the University of Oxford and completed a postgraduate program at the College of Europe in Belgium.

Mathias dos Santos Costa

Operations & Commercial

With 6 years of experience working in business intelligence for controlling, risk, and sales departments in multinational companies, Mathias joined the team in 2019 and is now responsible for the operational area at Hogan Investimentos. He consolidates and automates operational risk controls and develops structured risk analysis reports for all areas of the firm.

At Zurich Seguros, he worked in the risk department, assisting in the identification, mitigation, and control of insurance, market, credit, and operational risks by collecting, organizing data, and generating consolidated risk management reports. Mathias also worked at software companies (Sprinklr/SM Services), supporting the business development area with custom reports, actively participating in information gathering, and utilizing various market intelligence tools.

Mathias studied Actuarial Science at the Federal University of São Paulo – EPPEN (Paulista School of Politics, Economics, and Business).

Mohamed Mourabet

Member of the Executive Committee and Chief Investment Officer – CIO

With 25 years of experience in the Brazilian and Latin American equity markets, Mohamed oversees the implementation of Hogan’s research and decision-making processes, constantly seeking to improve them to ensure the repeatability and consistency of performance. Mohamed founded Victoire (now renamed Hogan) in 2004, where he managed the firm’s first strategy, Long Short Equities, coordinating the analysts’ agenda and testing the investment discipline of other managers. By crystallizing the lessons learned over recent market cycles and always prioritizing teamwork, the research process has evolved into a collaborative platform that ensures transparency and systematic discipline in Hogan’s research.

Mohamed led the equity division of Citigroup Asset Management in Brazil from 1997 to 2001. Prior to that, he was a buy-side analyst and manager at the Emerging Market Portfolio Group of Flemings between 1992 and 1997 (now J.P. Morgan Asset Management) in London and São Paulo. He began his career at Ernst & Young in Paris (1991) and served as CFO of Pulso Tecnologia (now SQIA) from 2001 to 2003 in São Paulo.

He graduated in Management (Maîtrise des Sciences de la Gestion and a Diplôme d’Études Supérieures Spécialisées) from Paris IX Dauphine. He holds a full associate degree from IMRO (1993) and served in the French army from 1990 to 1991, where he was awarded the National Defense Medal.

Giuliano Mazoni

Co-Manager, CGA

Giuliano Mazoni joined the team in 2019, coinciding with the rebranding of Victoire to Hogan Investimentos, where research was separated from decision-making. Leveraging his extensive background, Giuliano focuses on bottom-up research, also incorporating quantitative factors into his analysis. Throughout his career at Hogan, he has contributed to the development of new quantitative factors, analyses, and tools, enhancing the investment process and making decision-making more robust and well-informed. Giuliano plays a crucial role in filtering investment ideas for the validation process and actively participates in portfolio construction.

Giuliano’s career began in the Risk Management department of Bradesco Asset Management. He prepared risk reports for institutional and fixed income funds, conducted performance attribution for the Funds of Funds division, and carried out capacity studies for equity funds. Prior to that, he spent two years working with programming and data science.

He holds a degree in Mechanical Engineering and a technical degree in Data Processing, both from the State University of Campinas (UNICAMP).

Andreza Ribeiro

Investment Analyst

Andreza Ribeiro started her career in capital markets as an analyst in the Investment area of Hogan in 2021. Today, Andreza contributes with her critical spirit and objectivity in research and decision-making processes, employing a fundamentalist and quantitative approach in analyzing companies within the universe. She continually interacts with team members, monitors market analysts’ expectations, pricing/valuation discipline, and factor modeling.

With experience in operational, analytical, and financial management in engineering and sanitation companies, Andreza developed management reports and optimized control processes, besides having a background in data analysis.

She holds a degree in Production Engineering from Anhembi Morumbi University and studied Business at Stafford House International in Canada.

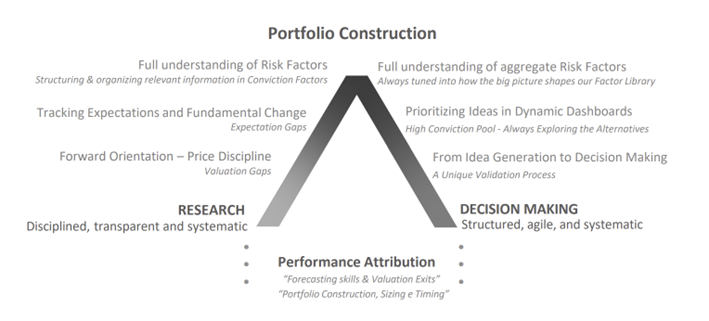

PROCESSES

• Processes are fundamental to achieving consistent performance over time.

• They promote objectivity and critical thinking in communication thanks to a structured language among team members.

• Our processes are permeated by transparency, discipline, and systematization to escape behavioral biases.

o Research Layer: The platform organizes, maps, and monitors relevant information in conviction factors in a structured manner.

o Decision-Making: The process offers a neutral, collaborative, and agile forum from idea generation to validation, prioritizing team members’ efforts.

CONTACT

CONTATO

Av. Nove de Julho, 5713 – SL 1

Itaim Bibi

São Paulo – SP

01407-200

+55 11 4872-4040